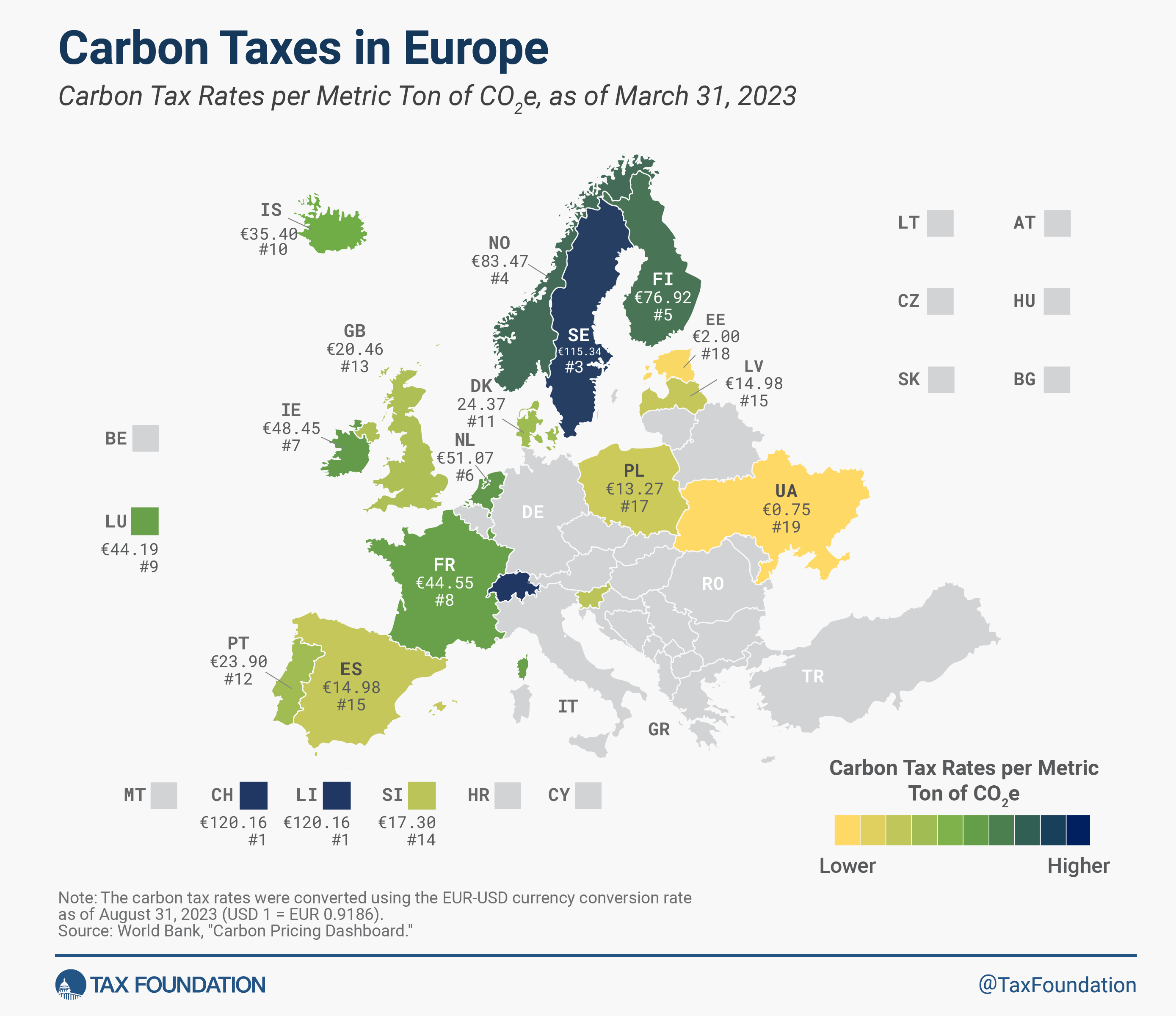

2023 Carbon Taxes in Europe

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax. Since then, 18 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

Switzerland and Liechtenstein currently levy the highest carbon tax rate at €120.16 ($130.81) per ton of carbon emissions, followed by Sweden (€115.34, $125.56) and Norway (€83.47, $90.86). The lowest carbon tax rates can be found in Ukraine (€0.75, $0.82) and Estonia (€2, $2.18).

Carbon taxes can be levied on different types of greenhouse gases, such as carbon dioxide, methane, nitrous oxide, and fluorinated gases. The scope of each country’s carbon tax differs, resulting in varying shares of greenhouse gas emissions covered by the tax. For example, Spain’s carbon tax only applies to fluorinated gases, taxing only 2 percent of the country’s total greenhouse gas emissions. Liechtenstein, by contrast, covers more than 81 percent of its greenhouse gas emissions.

All Member States of the European Union (plus Iceland, Liechtenstein, and Norway) are part of the EU Emissions Trading System (EU ETS), a market created to trade a capped number of greenhouse gas emission allowances. With the exception of Switzerland, Ukraine, and the United Kingdom, all European countries that levy a carbon tax are also part of the EU ETS. (Switzerland has its own ETS, which has been tied to the EU ETS since January 2020. Following Brexit, the UK implemented its own UK ETS as of January 2021.)

In Finland, Ireland, the Netherlands, and Norway, the national carbon tax base overlaps with the emission base also covered by the EU ETS, leading to double taxation of the overlap. When national carbon taxes apply to emissions covered by an ETS, they tend to shift the emissions to sources outside of their tax base, leaving total emissions capped by ETS allowances unchanged.

Some countries apply multiple excise taxes or ETSs to sources of carbon emissions at different implicit or explicit tax rates. In these cases, the table below displays the highest applicable rate. Ideally, a carbon tax should apply to the carbon emissions of all sectors at the same rate.

Several European countries have introduced a carbon tax or an ETS in recent years. The autonomous region of Catalonia is considering a carbon tax at the subnational level.

2023 Carbon Taxes in Europe

| Carbon Tax Rate (Per Ton of CO2e) | Share of Jurisdiction’s Greenhouse Gas Emissions Covered (2018) | Year of Implementation | ||

|---|---|---|---|---|

| Euros | U.S. Dollars | |||

| Denmark (DK) | €24.37 | $26.53 | 35% | 1992 |

| Estonia (EE) | €2.00 | $2.18 | 6% | 2000 |

| Finland (FI) | €76.92 | $83.74 | 36% | 1990 |

| France (FR) | €44.55 | $48.50 | 35% | 2014 |

| Iceland (IS) | €35.40 | $38.53 | 55% | 2010 |

| Ireland (IE) | €48.45 | $52.74 | 40% | 2010 |

| Latvia (LV) | €14.98 | $16.31 | 3% | 2004 |

| Liechtenstein (LI) | €120.16 | $130.81 | 81% | 2008 |

| Luxembourg (LU) | €44.19 | $48.11 | 65% | 2021 |

| Netherlands (NL) | €51.07 | $55.59 | 12% | 2021 |

| Norway (NO) | €83.47 | $90.86 | 63% | 1991 |

| Poland (PL) | €13.27 | $14.44 | 4% | 1990 |

| Portugal (PT)(a) | €23.90 | $26.01 | 36% | 2015 |

| Slovenia (SI) | €17.30 | $18.83 | 52% | 1996 |

| Spain (ES) | €14.98 | $16.31 | 2% | 2014 |

| Sweden (SE) | €115.34 | $125.56 | 40% | 1991 |

| Switzerland (CH) | €120.16 | $130.81 | 33% | 2008 |

| Ukraine (UA) | €0.75 | $0.82 | 71% | 2011 |

| United Kingdom (GB) | €20.46 | $22.28 | 21% | 2013 |

| €44.97 | $48.95 | 36% | ||

| EU ETS(b) (For Reference) | €88.46 | $96.30 | 38% | 2005 |

|

Notes: (a) Portugal ties its carbon tax rate to the previous year’s EU ETS allowances price. (b) The ETS price displayed is provided for reference only and subject to daily changes. Real-time and historical carbon price data can be tracked using financial information tools provided by relevant exchange platforms. The carbon tax rates were converted using the EUR-USD currency conversion rate as of August 31, 2023 (USD 1 = EUR 0.9186). |

||||

|

Sources: The World Bank, “Carbon Pricing Dashboard,” last updated Mar. 31, 2023, https:// carbonpricingdashboard.worldbank.org/map_data; Financial Administration, Republic of Slovenia – Environmental Taxes, retrieved Aug. 31, 2023. |

||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share